Zerodha Overnight Fund

A low-risk fund to park extra cash and earn daily returns

Returns

4.54%AUM

₹71.73Cr

Risk

Low

Min. Amount

₹100

Ideal for

Past Performance

Tax Implication

All gains/profits from the units of the Overnight Fund, irrespective of the holding period, will be considered as Short Term Capital Gains (STCG) and will be taxed as per the tax slab of the investor (plus 4% cess and surcharge, if any).

| Top Holdings | Weightage (%) |

|---|---|

| TREPS | 97.08 % |

| Treasury Bills | 2.79 % |

| Cash & Cash Equivalents | 0.12 % |

Fund Manager

Kedar has an experience of 19 years in financial markets, across multiple roles at Aditya Birla Sunlife AMC Ltd (ABSLAMC), including fund management for passive products, where he managed 13 ETFs and Index Funds in equity & commodity. Kedar's belief in his own words is - "Passive investing uses the collective intelligence of the market instead of manually picking stocks and works for most investors."

Downloads

Riskometer

Riskometer of the scheme

Riskometer of the scheme

Riskometer of the benchmark - NIFTY 1D Rate

This product is suitable for investors who are seeking*:

- Short Term savings

- To generate returns by investing in debt and money market instruments with overnight maturity

Investors should understand that their principal will be at Low Risk

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Other Funds

Frequently Asked Questions

Fund Overview

Zerodha Overnight Fund is a low-risk mutual fund designed for investors looking to park their surplus funds. It invests primarily in government-backed securities with a 1-day maturity, aiming to provide an efficient way to manage short-term funds with a relatively low interest rate and credit risk.

The minimum application amount is ₹100 and in multiples of ₹1 thereafter.

Mode of Investing

The Zerodha Overnight Fund is available on Coin by Zerodha, smallcase, Groww, Kuvera, Paytm Money, IND Money, CAMS Online, MFU and MFC and other such platforms.

Investors can invest in the Zerodha Overnight Fund via both Lumpsum and SIPs.

Yes, investors can start an SIP in this scheme with various frequencies (daily, weekly, fortnightly, monthly, quarterly, half-yearly, or yearly). Please refer to SID for more scheme related information.

Cost and Tax Implications

There is no exit load applicable on the Zerodha Overnight Fund.

The expense ratio of the Zerodha Overnight Fund is 0.08% as on Jan 28, 2026.

All gains/profits from the units of the Overnight Fund, irrespective of the holding period, will be considered as Short Term Capital Gains (STCG) and will be taxed as per the tax slab of the investor (plus 4% cess and surcharge, if any).

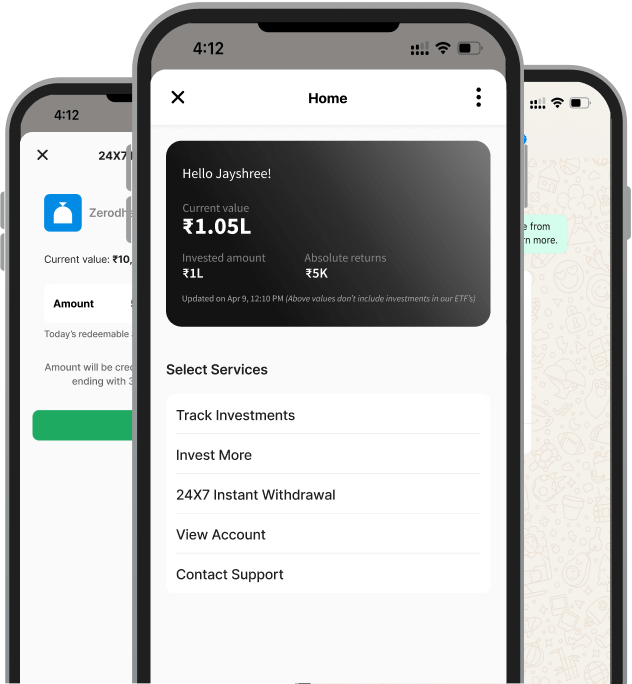

24x7 Instant Withdrawal Facility

Yes, there is an 24x7 Instant withdrawal facility available for Zerodha Overnight Fund that enables you to withdraw your invested amount instantly and receive the credit in your bank account within minutes. This service is available 24x7 daily via WhatsApp by Zerodha Fund House (+91-9845335486)

You can instantly withdraw the lower of these two amounts:

- ₹50,000

- 90% of your fund's portfolio value

This limit is applied per day, per scheme, per investor/PAN.

Any resident individual investor invested in Zerodha Overnight Fund in non-demat folio can access this facility 24x7 daily via WhatsApp by Zerodha Fund House (+91-9845335486).

The funds are transferred via IMPS (Immediate Payment Service) immediately after your OTP is verified. You should receive the credit in your bank account within minutes.

This is subject to delays that may occur due to banking or network issues beyond the AMC's/ Fund House's control.