Zerodha Nifty Short Duration G-Sec Index Fund

An index fund that invests in government securities of maturity ranging between 1 to 3 years

Returns

N/AAUM

₹16Cr

Risk

Low to Moderate

Min. Amount

₹100

Ideal for

About the fund

The Zerodha Nifty Short Duration G-Sec Index Fund is a debt index fund designed for investors looking to invest in government securities (G-Secs) with 1 to 3 year maturity.

The Zerodha Nifty Short Duration G-Sec Index Fund is a debt index fund designed for investors looking to invest in government securities (G-Secs) with 1 to 3 year maturity. Since the fund primarily invests in G-Secs, the underlying borrower is the Government. This structure ensures that the credit risk, which is the risk of default, is minimized to the lowest level possible in the domestic market, but it carries moderate interest rate risk. This fund may see moderate price fluctuations, due to fluctuations in the underlying market prices of the bonds.

This fund might be a good choice for someone who wants to park money for the short term (between 1 to 3 years), and is looking to generate income. It may also serve as a debt component for reducing overall portfolio risk.

With no lock-in or exit load, you can start a SIP or make a lump sum investment with a minimum amount of just Rs.100/-.

Past Performance

Tax Implication

All gains/profits from the units of the fund, irrespective of the holding period, will be taxed as per the tax slab of the investor (plus 4% cess and surcharge, if any)

| Top Holdings | Weightage (%) |

|---|---|

| 7.26% Govt 14-Jan-2029 | 69.21 % |

| 7.04% Govt 03-Jun-2029 | 26.85 % |

| Cash & Cash Equivalents | 3.95 % |

Fund Manager

Kedar has an experience of 19 years in financial markets, across multiple roles at Aditya Birla Sunlife AMC Ltd (ABSLAMC), including fund management for passive products, where he managed 13 ETFs and Index Funds in equity & commodity. Kedar's belief in his own words is - "Passive investing uses the collective intelligence of the market instead of manually picking stocks and works for most investors."

Downloads

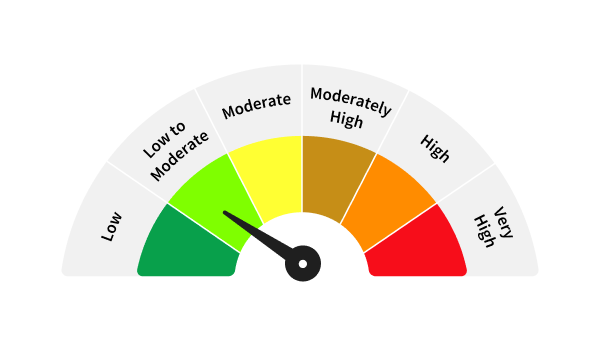

Riskometer

Riskometer of the scheme

Riskometer of the scheme

Riskometer of the benchmark - Nifty Short Duration G-Sec Index TRI

This product is suitable for investors who are seeking*:

- Short Duration Income

- Investment in securities in line with Nifty Short Duration G-Sec Index to generate comparable returns subject to tracking error

Investors should understand that their principal will be at Low to Moderate Risk

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Other Funds

Frequently Asked Questions

The fund invests primarily in Government of India securities (G-Secs). These are central government issued bonds. Specifically, it tracks the Nifty Short Duration G-Sec Index, meaning it holds a portfolio of bonds with short term maturities (duration) to mirror the index's performance.

The minimum investment amount for the fund via SIP or lumpsum is Rs.100/-.

As per current tax laws for debt mutual funds, gains from this fund are added to your total income and taxed according to your applicable income tax slab rates, regardless of how long you hold the investment.

The main differences are Credit Risk and Return Potential.

- Minimal Credit Risk: The Zerodha Nifty Short Duration G-Sec Index Fund invests in securities backed by a Sovereign Guarantee with minimal credit risk. In contrast, liquid funds can lend to corporations and banks, which inherently carry higher credit risk.

- Return Potential: While liquid funds aim for lower volatility, the Zerodha Nifty Short Duration G-Sec Index fund may offer a higher return potential with moderate volatility. Therefore, it is suitable for investors looking to park capital for a short duration (between 1 to 3 years) and are comfortable with some volatility.