What are Liquid ETFs and what role do they play in your Demat Account?

Imagine you’ve just sold a stock - let’s call it "Stock A" - to book a nice profit.

- Day 1: You place the sell order.

- Day 2: The stock leaves your Demat account.

- Day 3: The cash hits your trading/demat account.

Now you have a question: What do you do with that cash?

You could leave it there while you hunt for your next investment, or you could go through the hassle of transferring it back to your bank account. But here lies the problem:

- The "0% Return" Trap: While that money sits in your trading account, it earns zero interest. It’s essentially "idle capital."

- The Transfer: Moving money back and forth between your bank and broker takes some time and you would have to transfer it again to your demat account before making another investment.

Is there a way to keep your money ready for the next transaction while earning returns on it? Yes. Enter Liquid ETFs.

What is a Liquid ETF?

A Liquid Exchange Traded Fund (ETF) is a financial instrument designed to park surplus funds effectively. Think of it as a "digital parking lot" for your money that offers high liquidity and relatively low risk.

What do Liquid ETFs invest in?

Liquid ETFs primarily invest in low-risk, overnight instruments like Tri-Party Repos (TREPS), Government Securities (G-Secs), and Treasury Bills (T-bills). These instruments typically have a maturity of just 1 day, minimizing interest rate risk and credit risk. Unlike fixed deposits, there is no lock-in. You can buy and sell units on the stock exchange (NSE/BSE) during market hours, just like any other stock.

How do Liquid ETFs work?

While the concept of a Liquid ETF is simple, the way they deliver returns has changed significantly over the years. To understand the structure of Liquid ETFs, we have to look back at how it all started.

The Old Structure: The world's first Liquid ETF was actually launched back in 2003. At that time, dividends were not subject to taxation in the hands of investors. To maximize tax efficiency, these early ETFs were structured to pay returns in the form of daily dividends.

- How it worked: Instead of the NAV of the ETF units going up, the fund would credit your account with tiny "fractional units" every day.

- The Problem: While this saved tax back then, it created a challenge. Investors’ statements became cluttered with hundreds of tiny units (e.g., 0.004 units). Tracking your returns became a challenge.

How did Zerodha Fund House simplify liquid ETFs further?

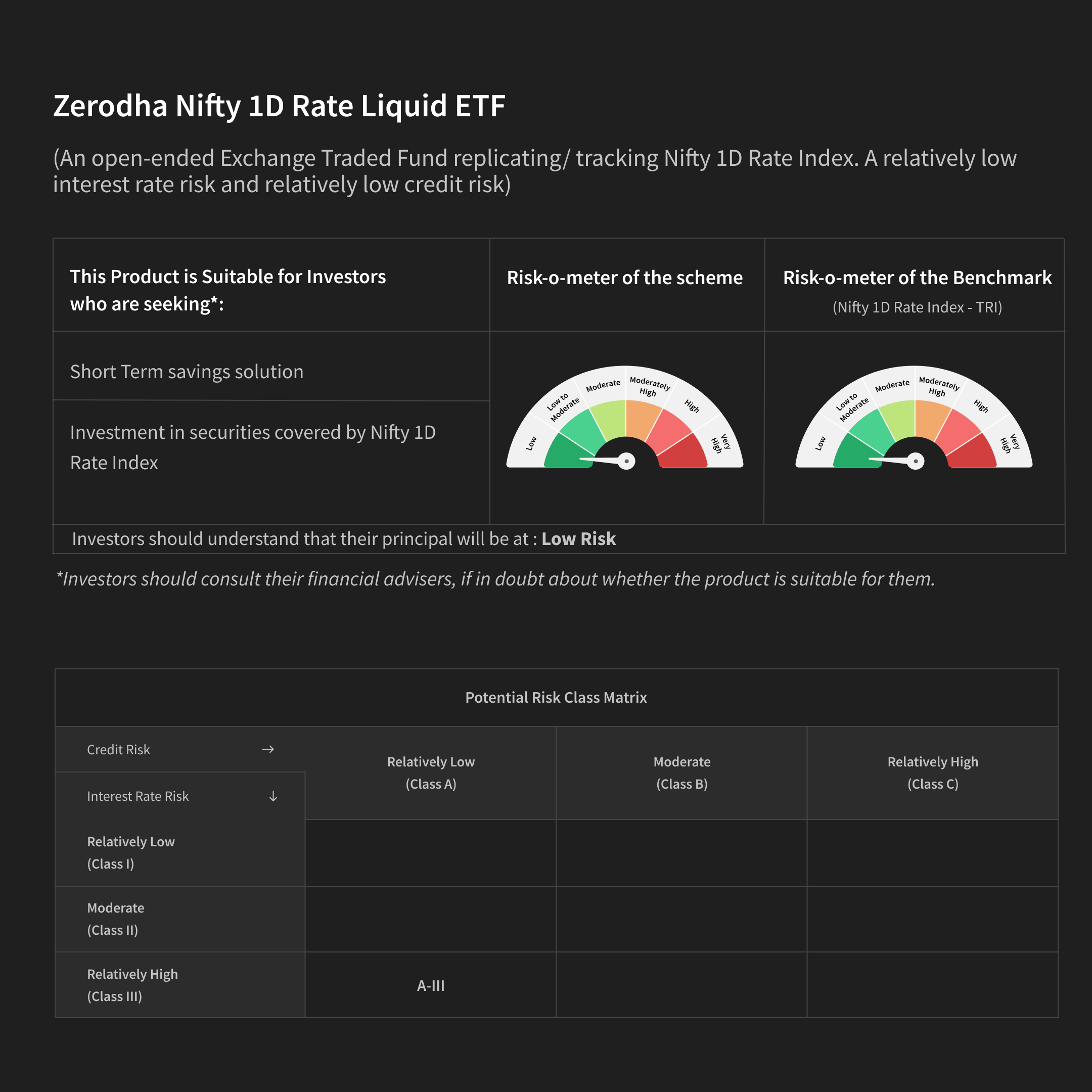

We realized that the product needed a revamp and that’s exactly what we did. We introduced India’s first Growth Liquid ETF - Zerodha Nifty 1D Rate Liquid ETF (NSE/BSE Symbol: LIQUIDCASE).

In LIQUIDCASE, the NAV changes like any other mutual fund scheme. A growth NAV ensures that returns are reflected in its price on a day-day basis. This innovative feature makes it easier for investors to track the ETF’s performance on a day to day basis. You are not taxed continuously on daily dividends. You pay tax only when you choose to sell your units, simplifying your taxation.

Within just a couple of years of launch, LIQUIDCASE has already crossed an AUM of 6,400 Cr as of Nov 2025 and is one of the top liquid ETFs in India in terms of AUM in India. [1]It ranks second in terms of total AUM across all other liquid ETFs in the category - as of Sep 2025.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully

Please note that this article or document has been prepared on the basis of internal data/ publicly available information and other sources believed to be reliable. The information contained in this article or document is for general purposes only and not a complete disclosure of every material fact. It should not be construed as investment advice to any party in any manner. The article does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Readers shall be fully liable/responsible for any decision taken on the basis of this article or document.