Milestone Model Portfolios: A Smarter Path to Your Long-Term Goals

Imagine you decide to get fit. You have two options:

- Go to the gym once a month and work out for 8 hours straight until you’re exhausted

- Go the gym for 30 minutes, three times a week, every week.

Which one do you think will give you better results in the long run? The second one, of course! Why? Because it’s a system. It’s a habit. It’s manageable, consistent and it works.

Investing is exactly the same. The goal isn’t to make one brilliant move that makes you rich overnight. The goal is to create a simple system that you can stick to for decades.

The most well known and effective system is the Systematic Investment Plan (SIP). You’re not worried if the market is up or down. You’re not tempted to “time the market”. Your only focus is disciplined investing at regular intervals.

But for long term goals like retirement, you need a system that’s not just disciplined, but also adapts as you get older.

Start with a Destination: Goal-Based Investing

Before you start a journey, you enter a destination into your maps app. Investing should be no different. This is called goal-based investing. You aren’t just investing: you’re investing for something specific.

Your goal has two parts:

1. What do you want to achieve? (e.g., retirement)

2. When do you want to achieve it? (e.g., the year 2040)

This is your milestone. Having a clear milestone, like “Retirement 2040”, turns a vague wish into a real target.

Now that you have a target in mind – you need a plan in place.

With such a long term goal in mind, the plan should help you keep your investing journey smooth and also potentially help you achieve your goal.

This is where something called a glidepath approach helps.

Visualising your Glidepath Investment Journey

So, what is this “glidepath”? Think of your investment journey like a long-haul flight.

- The Take-Off (Early Years): When an airplane takes off, it uses max. power to climb high and fast. Similarly, when your financial goal is decades away, your investment plan may be aggressive focusing on growth which means investing more in assets like equities (stocks), which have higher potential returns. You have plenty of time to potentially recover from market turbulence with the risk factors involved.

- Cruising Altitude (Middle Years): Once at high altitude, the plane cruises steadily. At that stage, your portfolio finds a balance. It still aims for growth but starts to mix in more stable investments to protect what you might’ve earned.

- The Smooth Landing (nearing Your Goal): As the plane prepares to land, the pilot doesn’t keep the engines at full throttle. They begin a slow, careful, and smooth descent. Your investment plan follows the same approach. As you get closer to your milestone year, the glidepath automatically and gradually shifts your money out of high-growth assets and into assets that offer balance and lowers risk like government securities and cash equivalents. This may help protect your accumulated wealth from any last-minute market storms.

Let’s visualize this journey with one of our model portfolios – Milestone 2040 Target Date

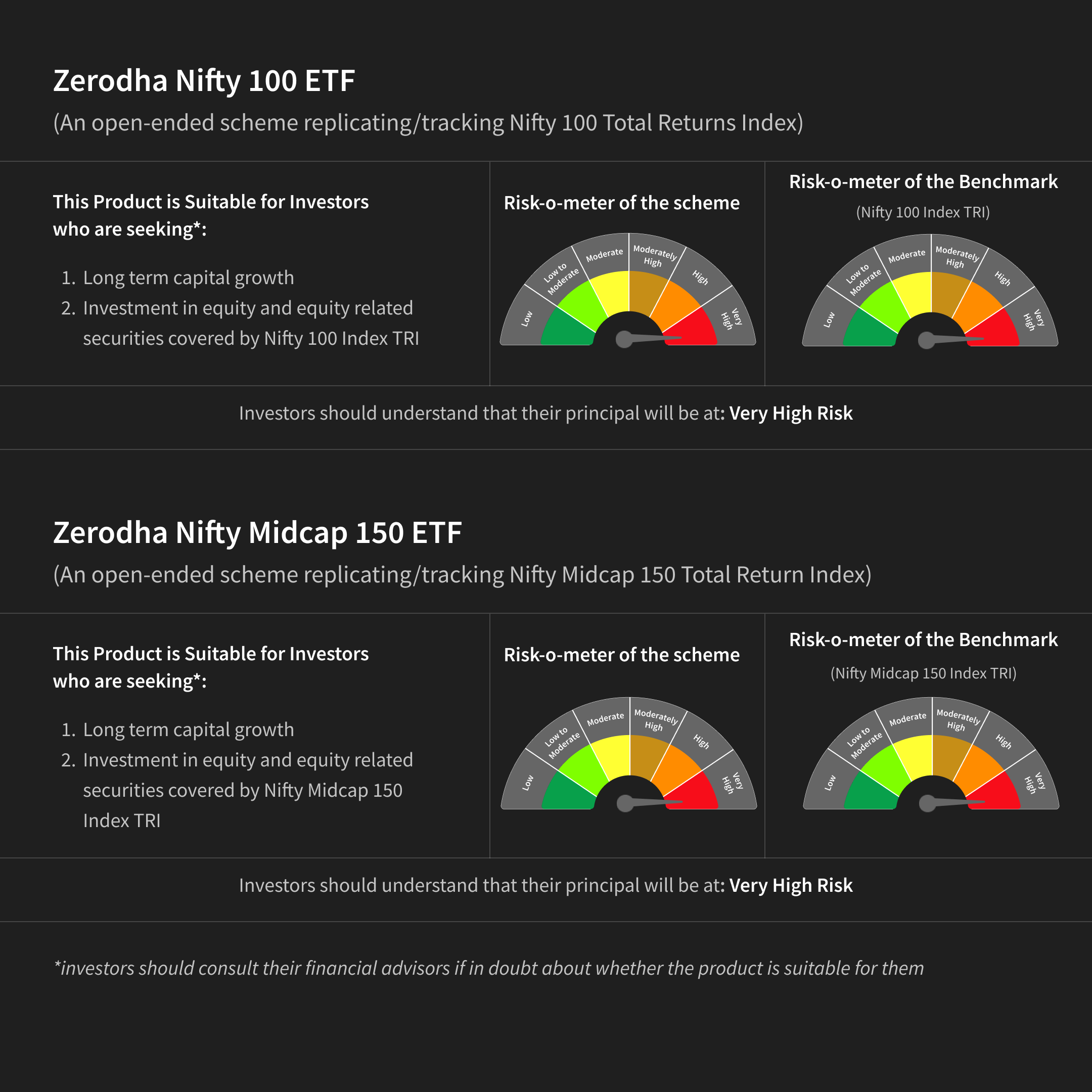

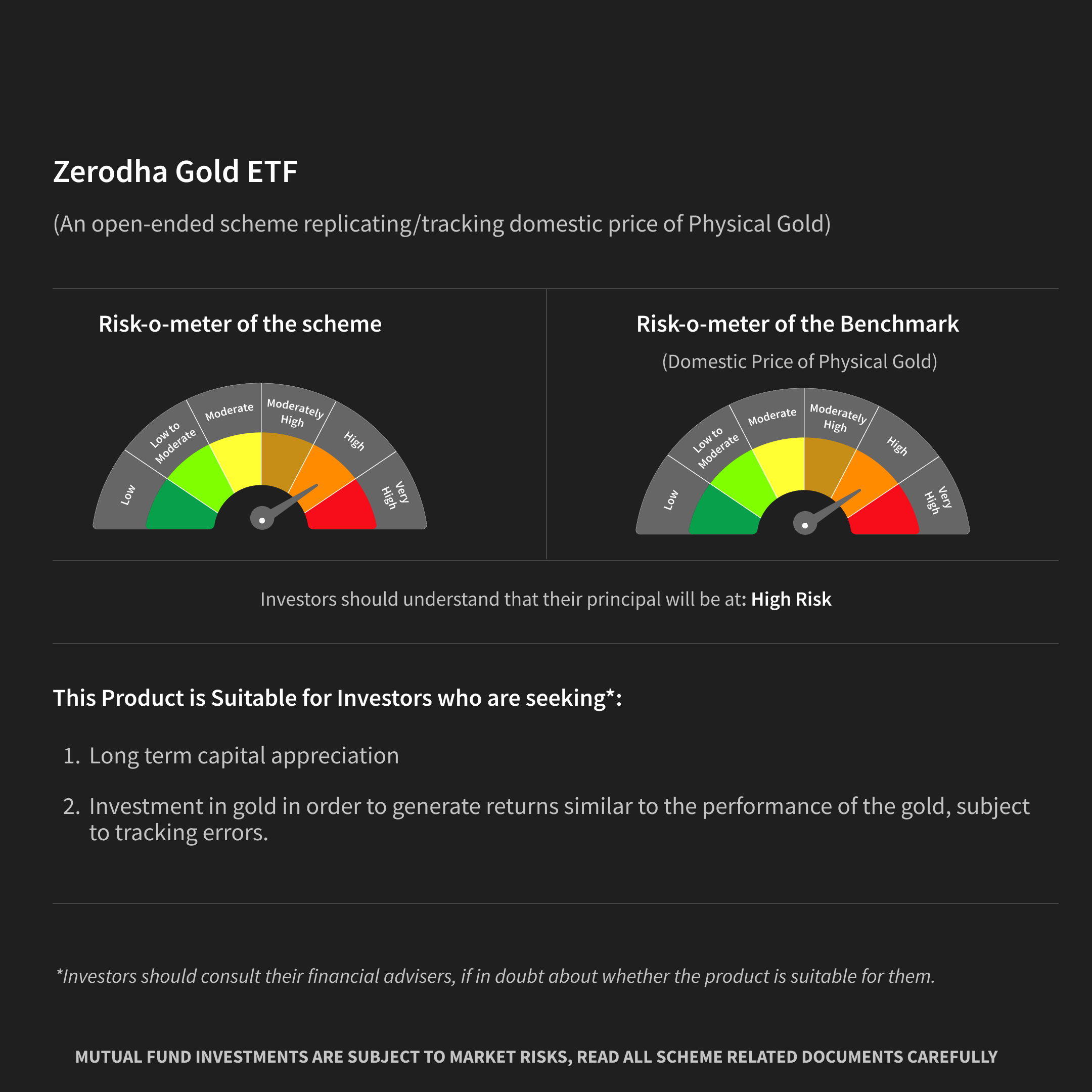

When your goal is many years away, the primary objective is capital appreciation. This is the accumulation phase of your long-term plan. At this early stage, the portfolio holds a higher percentage in equities and gold – represented by Zerodha Nifty 100 ETF and Zerodha Nifty Midcap 150 ETF. With time on your side, investment is positioned to seek higher potential growth.

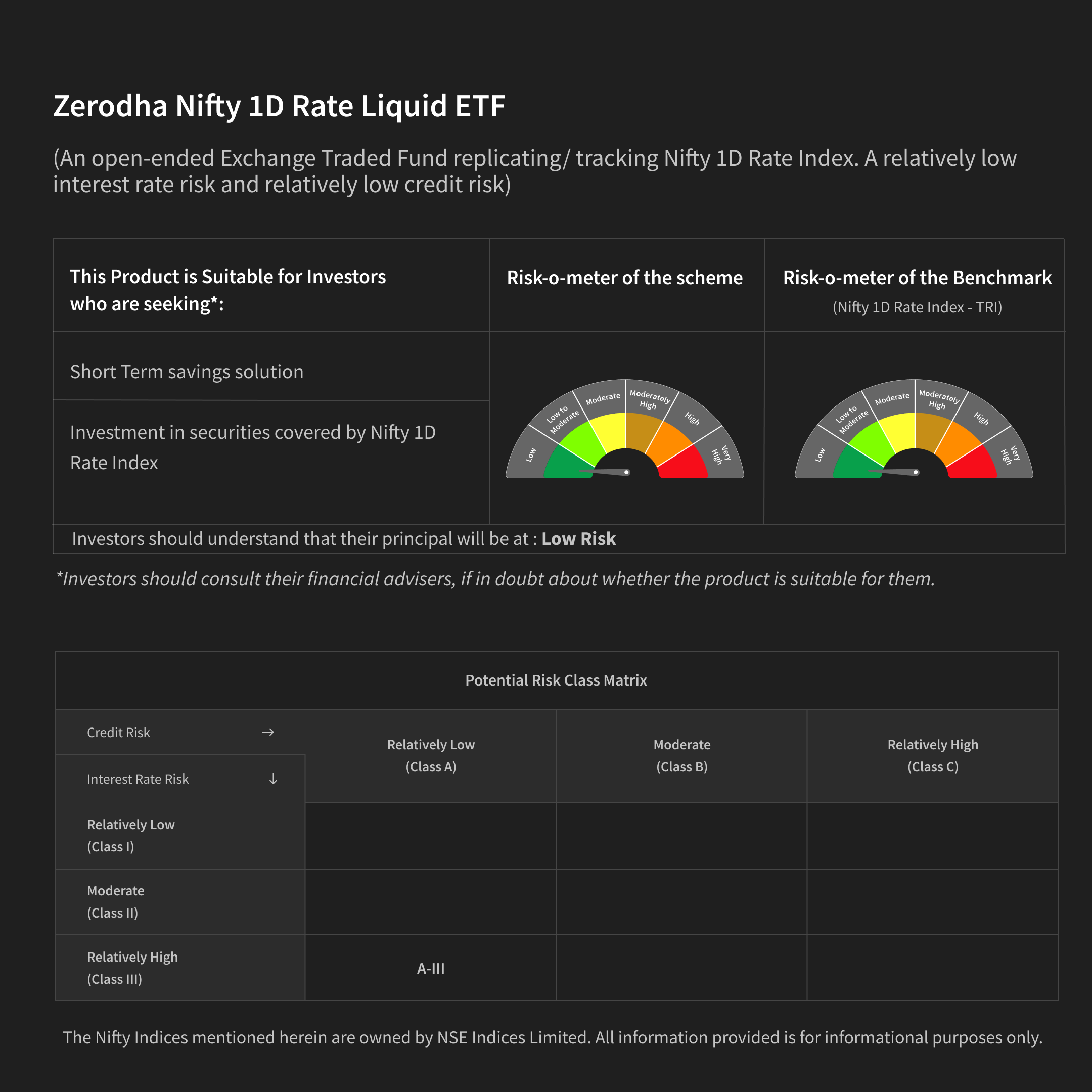

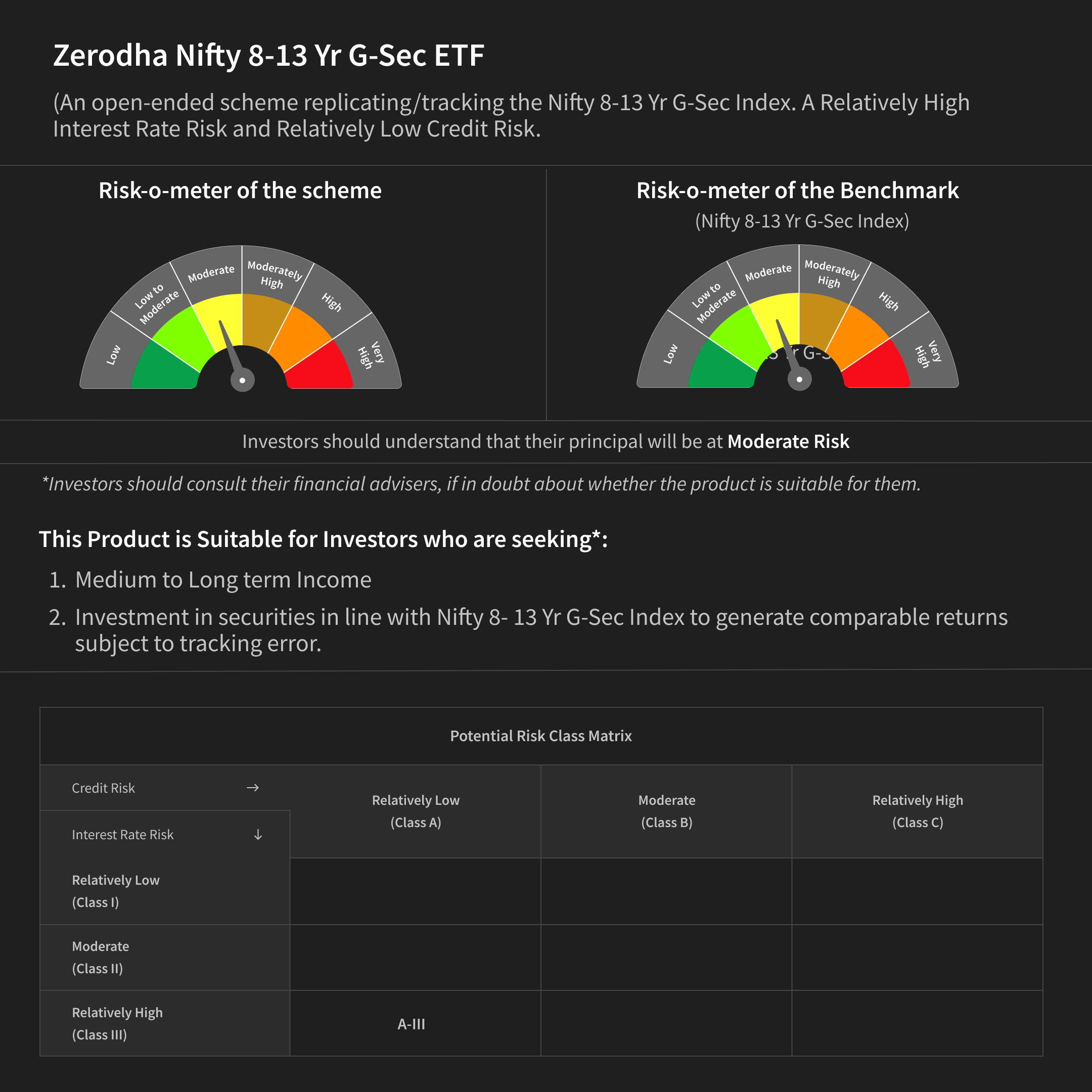

As time passes, the strategy begins a gradual transition. While growth is still important, protecting the wealth you might’ve already built becomes an increasing priority. You can see a clear and deliberate shift. The allocation to equities and gold is lower compared to the earlier years. More capital is moved into assets like G-Sec ETFs. This creates a more balanced approach between growing the investment and keeping it stable.

When you are in the final years of your investment journey plan, the primary objective shifts to preserving your capital. The focus is now on protecting the final value of your investment so it’s ready for you to use by the end of 2040. In this later stage, the portfolios hold most of their funds in more lower risk assets. The exposure to higher-risk equities is significantly reduced. This conservative allocation is designed to shield your accumulated wealth from potential market volatility right before you need it.

The above is just an example of the strategy for a portfolio that will mature in the year 2040. We also have other model portfolios which mature in the year – 2030, 2035, 2045, 2050, 2055 and 2060. To understand how the asset allocation changes over the years for all these portfolios – check this doc.

The Key Benefit: Disciplined Investing and Peace of Mind

The primary advantage of a target-date strategy like the plan above is that it automates one of the hardest parts of investing: managing risk over time.

- It instills discipline, preventing emotional decisions during market ups and downs.

- It provides a clear path towards your financial goals.

- It offers peace of mind, knowing your portfolio is automatically lower risk as you get closer to the year you’ll need your money.

By handling the task of rebalancing for you, it allows you to focus on your goal while your investment plan works intelligently in the background.

Disclaimers

Manager Disclosure

Zerodha Mutual Fund is registered with SEBI with MF/080/23/06 as the SEBI registration number. The registered office address of Zerodha Mutual Fund is New No. 51 Old No.14, INDIQUBE PENTA, Richmond Road, Bangalore, Bengaluru Urban, Karnataka, 560025, Bengaluru Urban, Karnataka, 560025. The CIN number of the company is U67190KA2021PTC155726.

The content and data available in the material prepared by the company and on the website of the company, including but not limited to index value, return numbers and rationale are for information and illustration purposes only. Charts and performance numbers do not include the impact of transaction fee and other related costs. Past performance does not guarantee future returns and performances of the portfolios are subject to market risk. Data used for calculation of historical returns and other information is provided by exchange approved third party vendors and has neither been audited nor validated by the Company. Detailed return calculation methodology is available here. Detailed volatility calculation methodology is available here.

Information present in the material prepared by the company and on the website of the company shall not be considered as a recommendation or solicitation of an investment. Investors are responsible for their investment decisions and are responsible to validate all the information used to make the investment decision. Investor should understand that his/her investment decision is based on personal investment needs and risk tolerance, and information present in the material prepared by the company and on the website of the company is one among many other things that should be considered while making an investment decision.

Zerodha Mutual Fund has a contractual arrangement with a vendor - CASE Platforms Private Limited (formerly known as “Smallcase Technologies Private Limited”; hereinafter “CPPL”); whereby CPPL provides technology solutions and related back-end infrastructure along with support for back-office related operations & processes. CPPL does not provide any investment advice or recommendation nor does it make any claim of returns or performance with respect to any advice or recommendation.

Investments in securities market are subject to market risks. Read all the related documents carefully before investing.

Registration granted by SEBI, membership of BSE and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

Zerodha Asset Management Private Limited (hereinafter referred to as “AMC”) is a SEBI registered Asset Manager (MF/080/23/06) and manages the schemes of Zerodha Mutual Fund. AMC is registered as a Private Limited Company under the Companies Act, 2013. The CIN number of the AMC is U67190KA2021PTC155726. The registered office and the correspondence address of the AMC is Indiqube Penta, New No. 51 (Old No.14), Richmond Road, Bangalore - 560025.

The AMC is not engaged in merchant banking, investment banking or any brokerage services.

The Model Portfolios created by Zerodha Asset Management Private Limited are provided solely for investors' convenience. Investors are free to invest in individual schemes (ETFs) independently. These combinations neither constitute investment advice nor advertisements of the constituent schemes and have been created without considering any specific investor's risk tolerance, financial requirements, or investment objectives. Investors are strongly encouraged to consult with their financial advisors, mutual fund distributors, or tax consultants to determine suitability before making any investment decisions. These Model Portfolios do not guarantee the achievement of any financial goal or assurance of targeted returns. For comprehensive information on individual schemes, its product label, risk-o-meter, etc., please refer to the respective Scheme Information Documents available on the website of the AMC, viz. www.zerodhafundhouse.com

of List and Details of the Group Companies of the AMC as per Regulation 26C of SEBI (Research Analysts) Regulations, 2014 and SEBI (Mutual Funds) Regulations, 1996 can be accessed from the website of the AMC, viz. www.zerodhafundhouse.com

Rebalancing of the model portfolio shall be carried out at the discretion of Zerodha Asset Management Private Limited and may not follow a fixed frequency. The timing and extent of any rebalancing will be determined based on the internal assessment of market conditions, risk factors, and investment strategy, and may be subject to change without prior notice.

Past performance is not indicative of future results, and there is no assurance that investment objectives or goals will be met.

The Nifty indices referred/mentioned in the Model Portfolios are owned by NSE Indices Limited.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY

Research Analyst Disclosures:

Research Analyst or Research entity and/or his/her relative's and/ or its associates may have financial interest and/or actual/beneficial ownership in the subject company(ies)**.

Research Analyst or Research entity and/or his/her relatives and/ or its associates have actual/beneficial ownership of 1% or more securities of the subject company(ies)**at the end of the month immediately preceding the date of publication of the model portfolio: No

Research Analyst or Research entity and/or his/her relatives and/ or its associates has any other material conflict of interest at the time of publication of the model portfolio: No

Research Analyst or Research entity and its associates have received any compensation from the subject company(ies) in the past 12 months: No

Research Analyst or Research entity and its associates have managed or co-managed public offering of securities for the subject company(ies) in the past 12 months: No

Research Analyst or Research entity and its associates have received compensation for investment banking or merchant banking or brokerage services from the subject company(ies) in the past 12 months: No

Research Analyst or Research entity and its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company(ies) in the past 12 months: No

Research Analyst or Research entity and its associates have received any compensation or other benefits from the subject company(ies) or third party in connection with the model portfolio: No

Individuals employed as research analysts by Research Analyst may have served as an officer, director or employee of the subject company(ies) in the past.

Research Analyst or Research entity and its associates or our associates have engaged in market making activity in relation to the subject company(ies): No

List and Details of the Group Companies of the AMC as per Regulation 26C of SEBI (Research Analysts) Regulations, 2014 and SEBI (Mutual Funds) Regulations, 1996 can be accessed from the website of the AMC, viz. www.zerodhafundhouse.com

**Subject company(ies) shall mean the schemes of Zerodha Mutual Fund forming part of the Model Portfolios.