Gold and Dhanteras: A Story of Tradition and Value

Every year, as homes light up with diyas and festive energy fills the air, one ritual remains timeless - buying gold on Dhanteras.

For centuries, gold has symbolized prosperity, protection, and permanence in Indian households. From grandparents setting aside a coin or two for good luck, to young investors buying digital gold or ETFs today - every generation has had its own relationship with this metal.

The tradition behind the shine

The word Dhanteras literally translates to the day of wealth. It marks the beginning of Diwali and is believed to bring good fortune when you purchase something valuable — and what could be more universal than gold?

Historically, families bought gold jewelry, coins, or utensils on this day to ensure prosperity in the year ahead. What started as a tradition has evolved into an annual reminder of our deep-rooted trust in gold as a store of value.

How has it fared

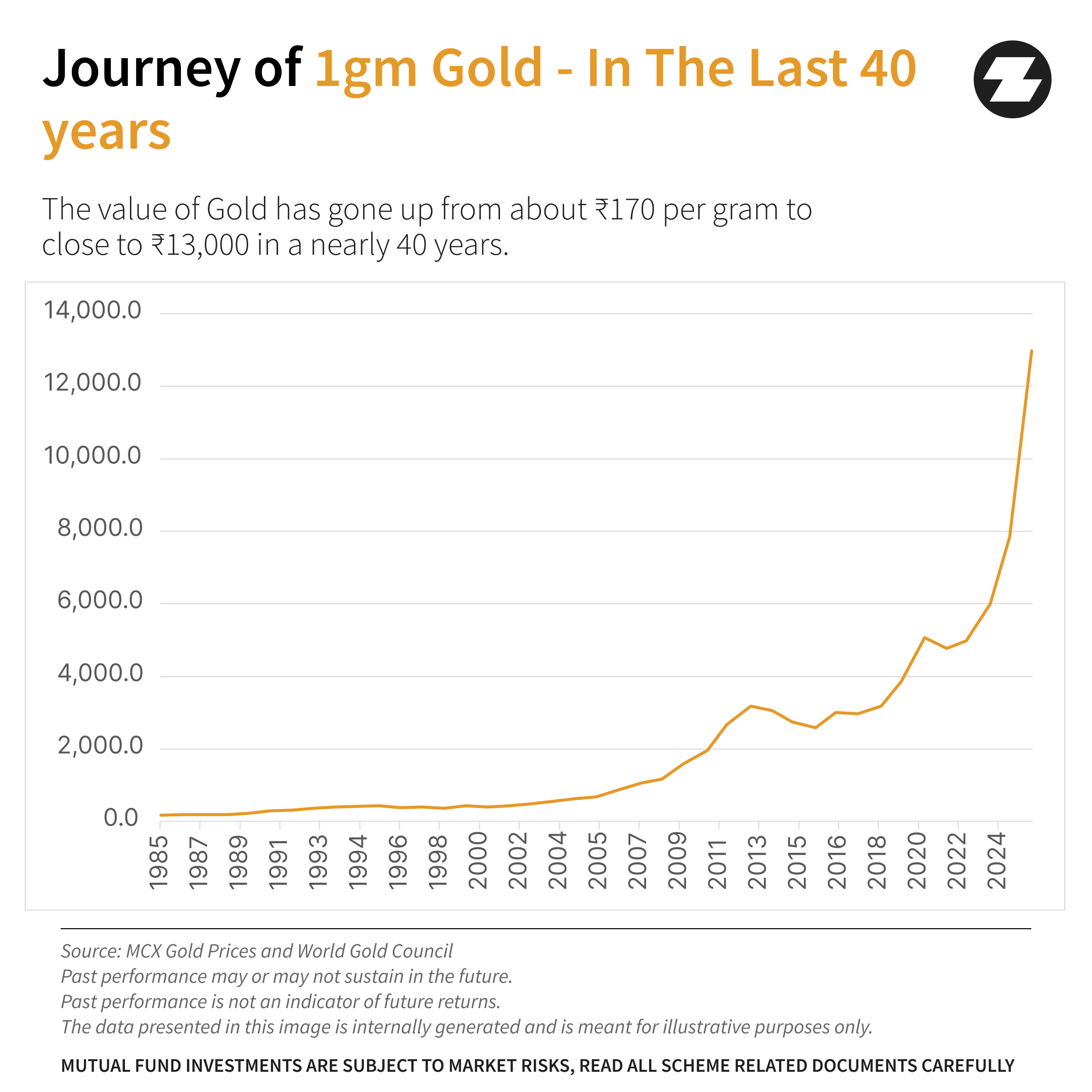

The value of Gold would have gone up from about ₹170 per gram to close to ₹13,000 in a period of approx. 40 years.

The message? Gold has quietly done what it’s always meant to do — protect and preserve value across generations.

But it’s not just about numbers. The reason gold has endured isn’t only financial. It’s emotional, cultural, and deeply human. People associate it with milestones - weddings, festivals, the birth of a child.

And while the form has changed — from jewelry to digital gold, from sovereign gold bonds to ETFs - the emotion remains the same: security and continuity.

Different Ways to invest in gold today

The way people buy gold has evolved just as much as our reasons for owning it. Here are some popular ways to invest today:

- Gold Jewelry or Coins: Traditional, but comes with making charges and storage concerns.

- Sovereign Gold Bonds (SGBs): Government-backed, earn interest, but with no fresh issuances.

- Gold ETFs: *Exchange Traded Funds that track gold prices and are held in your demat account — easy to buy, sell, and store. They are also regulated mutual fund schemes, unlike any other gold investment options which may have different risk and regulatory profiles.

Why more investors are choosing Gold ETFs

Gold ETFs offer a regulated modern, transparent, and cost-effective way to invest in gold:

- You own gold in a fully backed and insured electronic form.

- You can buy or sell anytime during market hours - just like a stock.

- No worries about purity or storage.

- Low expense ratios make it efficient for long-term investors.

For those who see gold as both a tradition and an investment, Gold ETFs bridge that beautifully — honoring the sentiment while keeping pace with modern investing.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully

Please note that this article or document has been prepared on the basis of internal data/ publicly available information and other sources believed to be reliable. The information contained in this article or document is for general purposes only and not a complete disclosure of every material fact. It should not be construed as investment advice to any party in any manner. The article does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Readers shall be fully liable/responsible for any decision taken on the basis of this article or document.

*Gold ETFs are subject to market risks and price fluctuations in gold and aim to closely track domestic gold prices; however, returns may differ slightly due to tracking error and fund expenses.

Published in 18th Oct 2025