Different Ways Of Investing in Gold and Silver

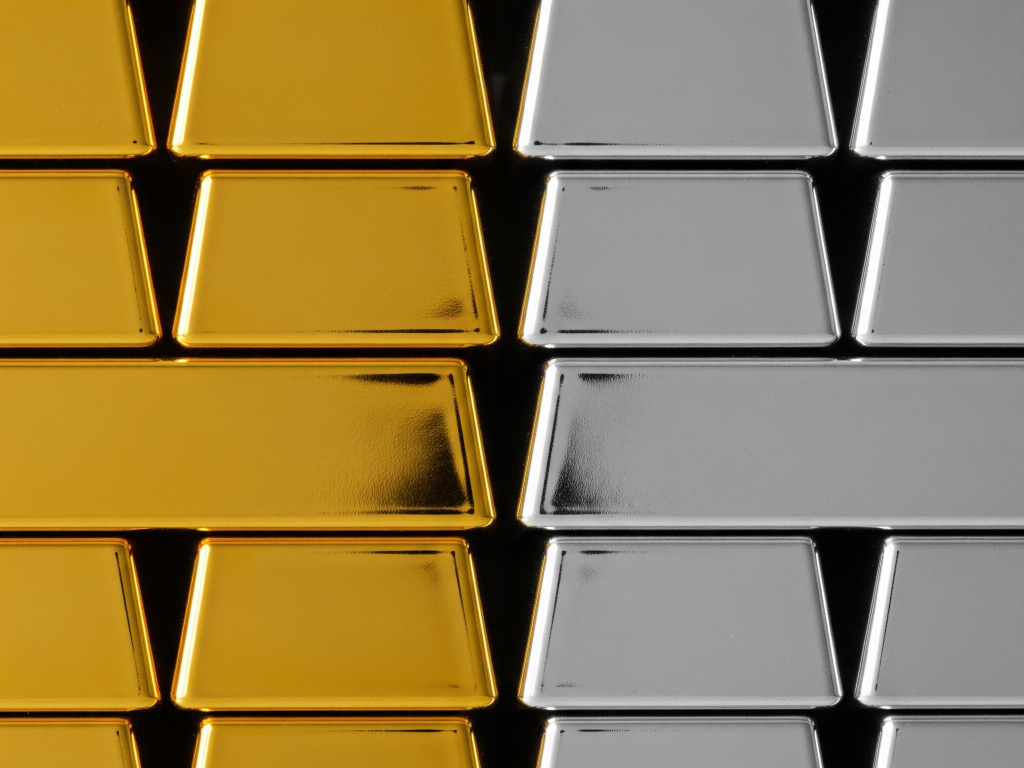

Investing in gold and silver can be a strategic move for portfolio diversification, hedging against inflation, and potentially generating returns. Both metals have distinct characteristics, with gold typically known for its store of value and silver for its industrial demand.

Here are the different options for investing in gold and silver:

Investing in Gold

1. Physical Gold

This is the most traditional way to buy gold.

Jewelry: While popular, gold jewelry often comes with "making charges" and purity concerns.

Coins and Bars (Bullion): These are typically considered purer forms of physical gold for investment. You can buy them from reputable dealers, banks, or online.

- Pros: Direct ownership, tangible assets.

- Cons: Storage and security concerns (theft, fire), potential for higher markups, purity verification needed.

2. Digital Gold

This allows you to buy and sell gold online without taking physical delivery.

- How it works: You purchase a specific amount of gold that is stored on your behalf in secure vaults by the provider. You can track its value online and often have the option to convert it to physical gold later (with delivery and making charges - as applicable).

- Pros: Convenience, low minimum investment, no storage worries.

- Cons: Lack of direct regulatory oversight (unlike ETFs or SGBs), some platforms may have investment limits or limited storage periods.

3. Gold Exchange-Traded Funds (Gold ETFs)

These are investment funds that track the price of physical gold.

- How it works: Gold ETFs are traded on stock exchanges just like stocks. One unit of a Gold ETF typically represents a certain quantity of physical gold with high purity (99.5% or higher), held by the fund.

- Pros: Can be bought and sold during market hours, no storage or purity concerns, no making charges compared to physical gold.

- Cons: Requires a Demat account, may trade at a slight premium or discount to the actual gold price due to market dynamics, other transactions charges such as STT.

4. Gold ETF Fund of Funds

These funds invest in Gold ETFs.

- How it works: Gold funds pool money from investors to invest in gold through Gold ETFs.

- Pros: No Demat account required, convenience of SIP (Systematic Investment Plan) for disciplined investing.

- Cons: Expense ratio (can be higher than ETFs)

6. Gold Futures and Options

These are derivative instruments that allow investors to trade on the future price of gold.

- Pros: High leverage, potential for significant gains, no physical handling.

- Cons: High risk, complex instruments, require active management, not suitable for all investors.

Investing in Silver

Many of the investment options for gold also apply to silver, with some key differences due to silver's dual role as both a precious metal and an industrial commodity.

1. Physical Silver

Similar to gold, you can buy physical silver in the form of coins, bars, or even jewelry.

- Pros: Tangible asset, direct ownership.

- Cons: Storage and security challenges, purity concerns.

2. Digital Silver

Available through various platforms, similar to digital gold.

- Pros: Convenience, low minimum investment, no storage hassle, can buy and sell online.

- Cons: Similar to digital gold, lack of explicit regulatory oversight.

3. Silver Exchange-Traded Funds (Silver ETFs)

These are mutual fund schemes that invest in physical silver or silver-related instruments.

- How it works: Similar to Gold ETFs, Silver ETFs track the price of physical silver. They are traded on stock exchanges, offering exposure to silver without needing to hold the physical metal.

- Pros: High liquidity, no storage or purity issues, transparent pricing and cost-efficient.

- Cons: Requires a Demat account

4. Silver Futures and Options

Derivative contracts based on silver prices.

- Pros: Leverage, potential for high returns.

- Cons: High risk, complex, require expertise.

Key Considerations When Investing in Gold and Silver

- Risk Tolerance: Silver is riskier than Gold and its price can fluctuate more due to its industrial demand.

- Investment Horizon

- Liquidity

- Costs: Factor in making charges (for jewelry), storage costs (for physical), expense ratios (for ETFs/fund of funds), and brokerage fees.

- Taxation:

*LTCG gains up to Rs 1.25 lacs are exempt in a financial year

Disclaimer - Please note that this article or document has been prepared on the basis of internal data/ publicly available information and other sources believed to be reliable. The information contained in this article or document is for general purposes only and not a complete disclosure of every material fact. It should not be construed as investment advice to any party in any manner. The article does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Readers shall be fully liable/responsible for any decision taken on the basis of this article or document.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully

Published on July 3rd, 2025