Chhoti SIPs: Start Investing with a 250/- SIP

The first step in any journey is often the hardest, and this is especially true for investing. Many believe you need a large sum of money to begin, but that’s no longer the case. With the introduction of "Chhoti SIPs," or small-ticket Systematic Investment Plans, the doors to mutual fund investing are open to first time investors excluding minors. This initiative's main objective is to make mutual fund investing more accessible and encourage first-time investors to enter the mutual fund space.

A Chhoti SIP is more than just a small investment; it's a powerful tool for building financial discipline. It allows you to invest a fixed, manageable amount monthly, turning the act of saving into a consistent habit. These ₹250 SIPs are designed to help new investors ease into the market, making wealth creation an attainable goal without requiring a significant financial outlay. One of the greatest advantages of starting small and staying consistent is the power of compounding.

The facility is available exclusively to first-time individual investors in the mutual fund industry, excluding minors. To know more about the features of this facility, check this link.

Getting started is straightforward. You can use familiar digital payment methods like NACH or UPI to automate your monthly investments. You also have the flexibility to hold your investments either in a Statement of Account (SOA) format, directly with the fund house, or within your Demat account. While these SIPs encourage a long-term commitment, you have the freedom to withdraw your money at any time, subject to the scheme's applicable exit load.

By taking that first small step, you are not just investing money; you are investing in a disciplined financial future.

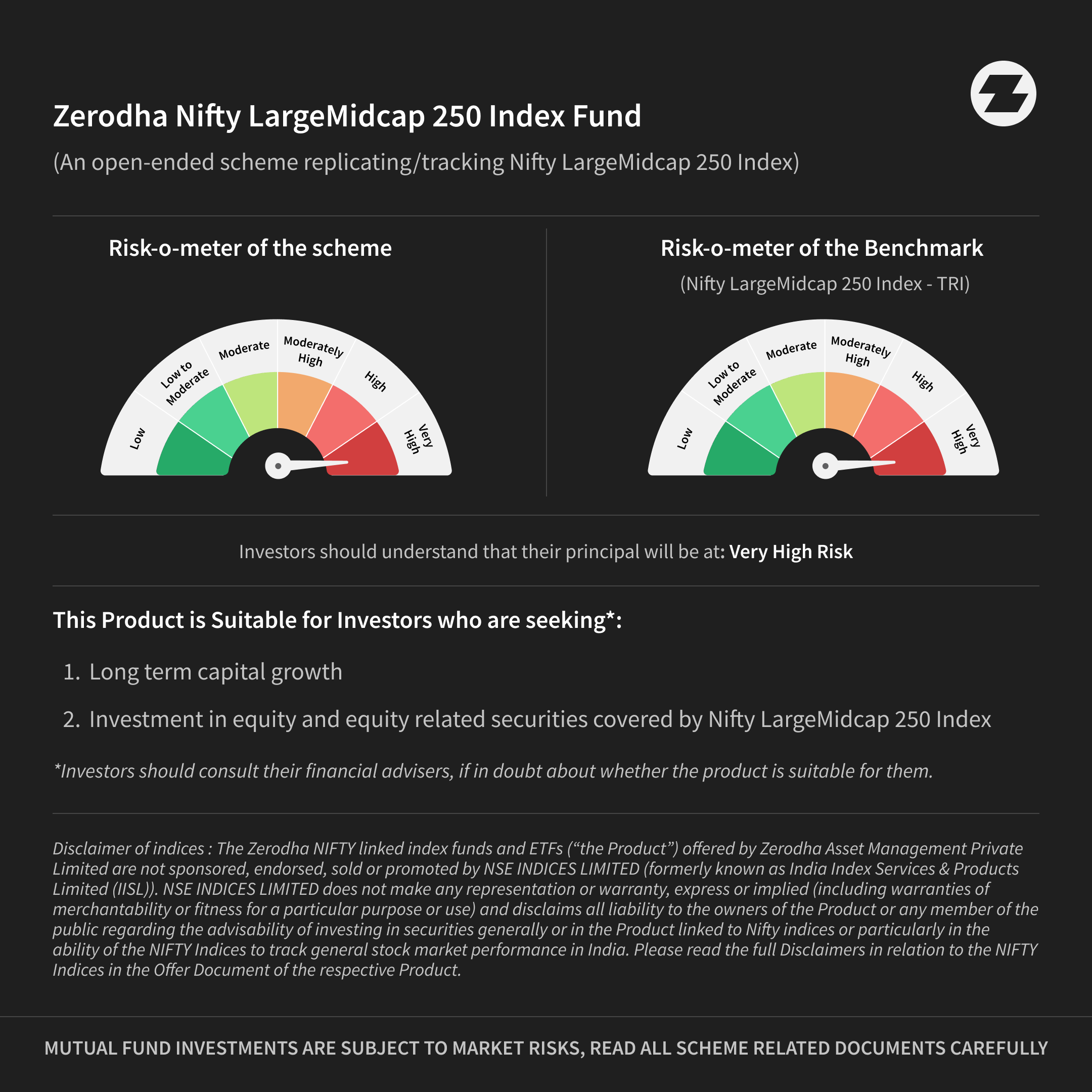

Effective July 21, 2025, the Chhoti SIP facility is available for investments in Zerodha Nifty LargeMidcap 250 Index Fund. This aligns perfectly with the ongoing efforts to lower entry points for investors, allowing even more people to benefit from long-term investing habits. You can explore this scheme here.

Disclaimer - Please note that this article or document has been prepared on the basis of internal data/ publicly available information and other sources believed to be reliable. The information contained in this article or document is for general purposes only and not a complete disclosure of every material fact. It should not be construed as investment advice to any party in any manner. The article does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Readers shall be fully liable/responsible for any decision taken on the basis of this article or document.

Chhoti SIP is only a method of investing, not a separate product. It follows the terms and conditions of the scheme it is invested into. Hence, exit load applicable to that mutual fund scheme will continue to apply to units purchased via Chhoti SIP.

The Chhoti SIP facility is applicable for the above mentioned scheme only for monthly SIPs.

Published on 12th Aug, 2025